geothermal tax credit new york

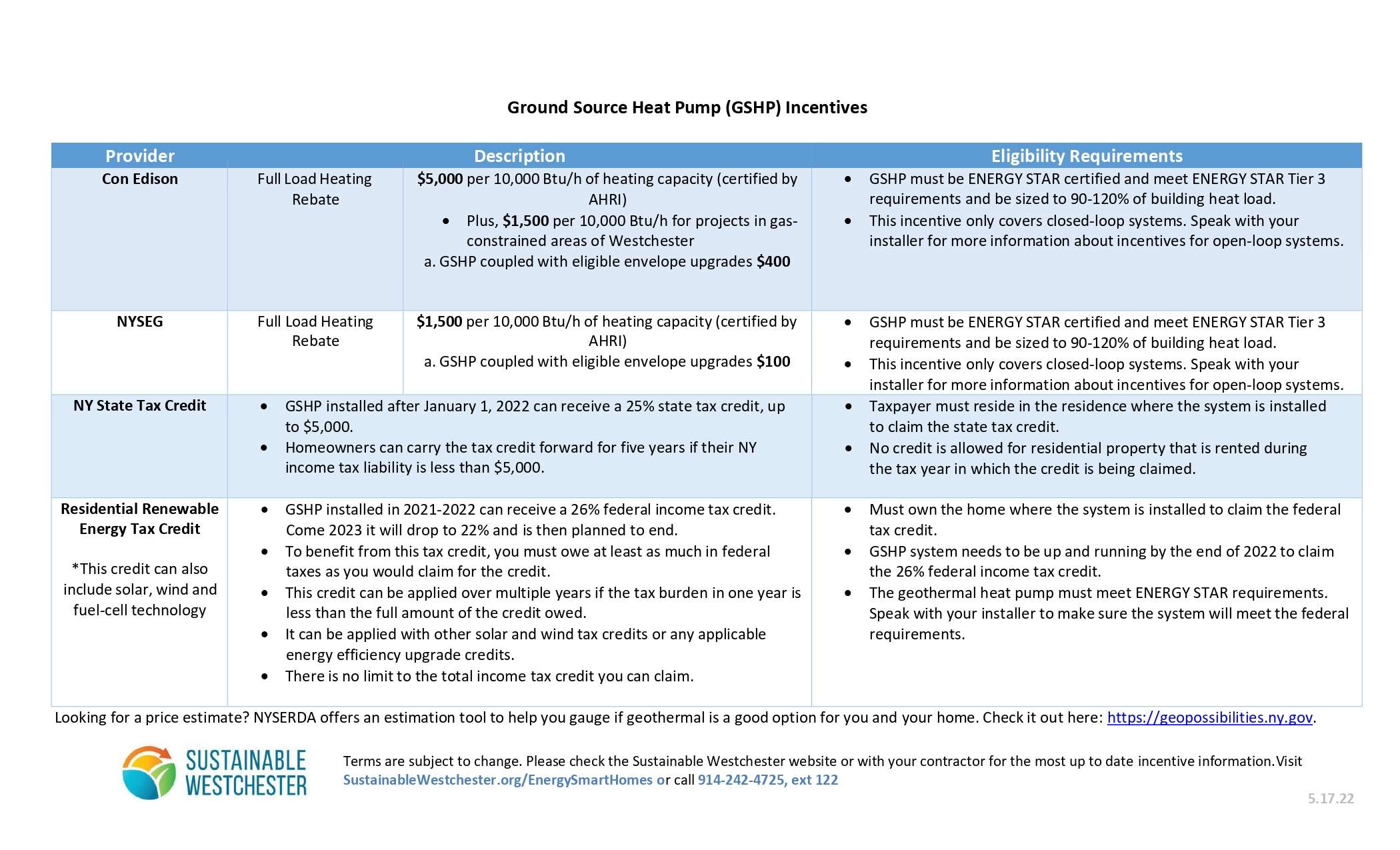

Combined with the current 26 federal tax credit for geothermal systems state incentives now give residents in most parts of New York an average of 50 reduction in what the usual costs of geothermal would be. Federal Geothermal Incentives.

_960x960.jpg)

Icelandic Adventure Iconic New York Tour Trailfinders Ireland

Section 606 of the tax law is amended by adding a new subsection g-3 to read as follows.

. New York State offers a 25 tax credit on geothermal installation expenses up to 5000. Next up is NY State Assembly Bill A5508 for NY State Sales. Its a dollar-for-dollar reduction on the income tax you owe.

See Our Other Offices. For homeowners it extends the Energy Investment Tax Credit for clean energy home improvements providing a 30 percent credit for geothermal heat pump projects installed before January 1 2033. Check 2022 Top Rated Solar Incentives in New York.

New York City Real Property Tax Abatement Program. The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5000. New York offers state solar tax credits capped at 5000.

In order to qualify for the Federal Tax Credit you must have some level of. It now is before Governor Andrew Cuomo for signature and adoption or veto. Utility Incentives On average a 2500 square foot home that installs a 5 Ton 47900 BTUH Heat Pump will receive the following local utility incentives.

The Renewable Heat Now Campaign is organizing to win funding and policies that will get fossil fuels out of our buildings affordably and equitably The legislative package includes a geothermal tax credit S3864A7493 and sales tax exemption S642aA8147 as well as the All-Electric Building Act S6843a A8431 that would sunset fossil fuels in new construction starting. Lets break down what that means. Frequently Asked QuestionsDoes Geothermal Make Sense in New YorkOf course.

Taxpayers could get a tax credit equal to 25 on geothermal energy system expenditures up to 5000 according to a budget bill introduced by the Assembly. Dandelion Energy the nations leading home geothermal company celebrates the passing of the New York state budget which includes a new tax credit for residential geothermal heat pump installations in New York. Ad Enter Your Zip Code - Get Qualified Instantly.

And in New York lawmakers approved a tax credit to encourage homeowners to install geothermal heat pumps. You can claim the credit for your primary residence vacation home and. AN INDIVIDUAL TAXPAYER SHALL BE ALLOWED A CREDIT AGAINST THE TAX IMPOSED BY THIS ARTI- CLE EQUAL TO TWENTY-FIVE PERCENT OF QUALIFIED GEOTHERMAL ENERGY SYSTEM EXPENDITURES EXCEPT AS.

As of 2022 the Geothermal Federal Tax Cred it allows you to deduct 26 of the cost of installing a geothermal heating and cooling system from your federal taxes. Check Rebates Incentives. The incentive will be lowered to 26 for systems that are installed in 2033 and 22 in 2034 so act quickly to save the most on your installation.

The credit is equal to one cent for each percent of biodiesel per gallon of bioheating fuel purchased before January 1 2023. 866-NYSERDA Toll free Fax. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income.

Household credit New York State New York City Noncustodial parent earned income credit. Additionally homeowners are eligible for New York States Clean Heat Program which is administered by the homeowners utility. On February 1 you purchase 250 gallons of bioheating fuel to be used for residential heating purposes within New York State.

This bill allows for a 25 state income tax credit up to a maximum of 5000 for a new geothermal HVAC system. The bioheating fuel contains 20 biodiesel B20. New York State offers a 25 tax credit on geothermal installation expenses up to 5000.

A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032. The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for five years. Child and dependent care credit New York State New York City College tuition credit Earned income credit New York State New York City Empire State child credit.

This credit falls to 26 percent in 2033 and 22 percent in 2034. The New York Geothermal Energy Organization is a non-profit organization representing ground source heat pump GSHP installers manufacturers distributors general contractors engineers renewable energy consultants and industry stakeholders from throughout New York State. That incentive is set to go down to 22 in 2023 before being sunset altogether in 2024.

The state also passed a law earlier this year that allows utilities to create. Theres no limit on its value. Open Monday - Friday.

G-3 GEOTHERMAL ENERGY SYSTEMS CREDIT. The solar energy system equipment credit is not refundable. The Ne w York State Assembly and Senate have passed the Geothermal Tax Credit bill A2177A A2177A-2015.

It may not exceed 20 cents per gallon. Lets go over some important details to explain how these incentives are allocated. It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what you owe.

New Yorkers have more reason than ever to move towards air and ground source heat pumps. Enter Your Zip See If You Qualify. The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for five years if their New York income tax liability is.

The Geothermal Tax Credit is classified as a non-refundable personal tax credit. 2 days agoThose two states produce about 95 of the nations geothermal power with Hawaii Idaho New Mexico Oregon and Utah contributing much smaller amounts. However any credit amount in excess of the tax due can be carried over for up to five years.

Geothermal makes sense in any stateWhy are more homeowners in New York switching to Geo30 Federal Tax Credits 1000 per system local rebate and a payback or Return on Investment of 5 to 7 yearsWhat is the process for installing a geothermal system in NY.

Solar Incentives Aces Energy Wny Geothermal And Solar Installer

The First Commercially Licensed Grid Connected Wave Energy Device In The Nation Designed By Ocean Power Technolo Longitudinal Wave Physics Experiments Physics

Graph Of The Day The Climate Risks Of Natural Gas Www Reneweconomy Com Au Climates Gas Climate Change

Power Of Earth Geothermal Heating Ep 2 Conedison Incentives With Mark Brescia Climatemaster Geothermal Hvac

A Green Public Works Program For Nyc 40 Ideas From Experts Center For An Urban Future Cuf

Heat Pumps Heatsmart Flx South

Geothermal Heat Pump Sustainable Westchester

Solar Incentives Aces Energy Wny Geothermal And Solar Installer

![]()

All Archives Fractracker Alliance

Six Tax Credits Every Nyc Homebuyer Needs To Know 20 Nyc Listings With 421 A Tax Abatements Cityrealty

Ludhiana Travel Traveling Lodhifort Zoo Animals Photos Zoo Animals Lincoln Park Zoo

Gov Signs 3 Bills Into Law To Spur More Solar Pv Installations In New York Http Globalgreencapacity Com Solar Solar Energy Solar Power Source

Solar Energy Infographic What If Solar Were On Every Family S Roof Paneles Solares Energia Renovable Energia Sustentable

The Final Walk Through Explained For Nyc Nyc Finals Explained

A Green Public Works Program For Nyc 40 Ideas From Experts Center For An Urban Future Cuf

Downtown Yonkers A Cleaner Greener Place To Call Home The New York Times